SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

¨ | | Preliminary Proxy Statement x Definitive Proxy Statement

|

| |

¨ Definitive Additional Materials¨ Soliciting Material Pursuant to § 240.14a-12

| | ¨Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

Iridium Communications Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to § 240.14a-12 |

Iridium Communications Inc. |

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement if Other Than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box) |

| |

| ¨ | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | 1. | | Title of each class of securities to which transaction applies: |

| | | | |

| | 2. | | Aggregate number of securities to which transaction applies: |

| | | | |

| | 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | 4. | | Proposed maximum aggregate value of transaction: |

| | |

| | | | |

| | | | | | | ¨ | | Fee paid previously with preliminary materials. |

| | | ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | | 6. | | Amount Previously Paid: |

| | | | | | | 7. | | Form, Schedule or Registration Statement No.: |

|

| | | | |

IRIDIUM COMMUNICATIONS INC.

1750 Tysons Boulevard, Suite 1400

McLean, Virginia 22102

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 4, 201122, 2014

Dear Stockholder:

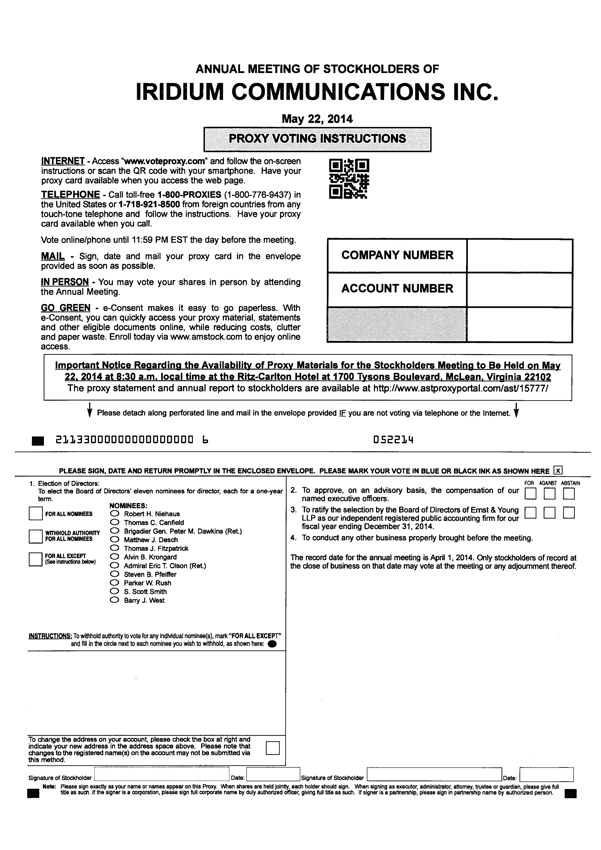

You are cordially invited to attend the Annual Meeting of Stockholders of Iridium Communications Inc., a Delaware corporation. The meeting will be held on Wednesday,Thursday, May 4, 201122, 2014 at 9:008:30 a.m. localEastern time at our corporate headquarters locatedThe Ritz-Carlton, Tysons Corner at 17501700 Tysons Boulevard, Suite 1400, McLean, Virginia 22102 for the following purposes:

| 1. | To elect the Board of Directors’ teneleven nominees for director, each for a one-year term.to serve until the next annual meeting and until their successors are duly elected and qualified; |

| 2. | To approve, on an advisory basis, the compensation of our named executive officers, as disclosed in the Proxy Statement accompanying this Proxy Statement.Notice; |

| 3. | To indicate, on an advisory basis, the preferred frequency of stockholder advisory votes on the compensation of our named executive officers.

|

4. | To ratify the selection by the Board of Directors of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2011.2014; and |

5.4. | To conduct any other business properly brought before the meeting. |

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the annual meeting is March 23, 2011.April 1, 2014. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on May 22, 2014 at 8:30 a.m. local time at The Ritz-Carlton, Tysons Corner, 1700 Tysons Boulevard, McLean, Virginia 22102 The proxy statement and annual report to stockholders are available at http://www.astproxyportal.com/ast/15777/. |

Important Notice Regarding the Availability of Proxy Materials for the Stockholders’ Meeting

to Be Held on May 4, 2011 at 9:00 a.m. local time at

the offices of Iridium Communications Inc., 1750 Tysons Boulevard, Suite 1400, McLean, Virginia 22102

The proxy statement and annual report to stockholders

are available at http://www.amstock.com/ProxyServices/ViewMaterials.asp?CoNumber=15777.

|

| By Order of the Board of Directors |

|

|

|

| Thomas D. Hickey |

| Secretary |

By Order of the Board of Directors

Christian O’Connor

Secretary

McLean, Virginia

April 8, 2014

|

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy, or vote over the telephone or the Internet as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder. |

PROXY STATEMENT SUMMARY

This summary highlights selected information contained elsewhere in our Proxy Statement. The summary does not contain all of the information that you should consider, and you should read and consider carefully the more detailed information contained in this Proxy Statement before voting.

2014 Annual Meeting of Stockholders

| | |

| Time and Date: | | 8:30 a.m. Eastern time on Thursday, May 22, 2014 |

| |

| Place: | | The Ritz-Carlton, Tysons Corner, 1700 Tysons Boulevard, McLean, Virginia 22102 |

| |

| Record Date: | | April 1, 2014 |

| |

| Voting: | | Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on. |

Meeting Agenda and Voting Matters

| | | | | | |

Agenda Items | | Board Vote

Recommendation | | Page Reference

(for more detail) |

| 1. | | To elect the Board of Directors’ eleven nominees for director, each to serve until the next annual meeting and until their successors are duly elected and qualified. | | FOR EACH DIRECTOR

NOMINEE | | 10 |

| | | |

| 2. | | To approve, on an advisory basis, the compensation of our named executive officers, as disclosed in this Proxy Statement. | | FOR | | 20 |

| | | |

| 3. | | To ratify the selection by the Board of Directors of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2014. | | FOR | | 21 |

| | | |

| 4. | | To conduct any other business properly brought before the meeting. | | | | |

Board Nominees

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Age | | | Director

Since | | | Independent | | | Committees | | | Other Current Public

Company Boards |

Name | | | | | AC | | | CC | | | NGC | | |

Robert H. Niehaus | | | 58 | | | | 2008 | | | | X | | | | | | | | M | | | | | | | Heartland Payment

Systems, Inc. |

Thomas C. Canfield | | | 58 | | | | 2008 | | | | X | | | | M | | | | | | | | M | | | — |

Brigadier Gen. Peter M. Dawkins (Ret.) | | | 76 | | | | 2009 | | | | X | | | | M | * | | | | | | | | | | — |

Matthew J. Desch | | | 56 | | | | 2009 | | | | | | | | | | | | | | | | | | | — |

Thomas J. Fitzpatrick | | | 56 | | | | 2013 | | | | | | | | | | | | | | | | | | | — |

Alvin B. Krongard | | | 77 | | | | 2009 | | | | X | | | | | | | | M | | | | C | | | Under Armour, Inc., Apollo

Global Management, LLC |

Admiral Eric T. Olson (Ret.) | | | 62 | | | | 2011 | | | | X | | | | | | | | | | | | M | | | Under Armour, Inc. |

Steven B. Pfeiffer | | | 67 | | | | 2009 | | | | X | | | | | | | | C | | | | | | | Barloworld Limited |

Parker W. Rush | | | 54 | | | | 2008 | | | | X | | | | C | | | | | | | | | | | — |

S. Scott Smith | | | 55 | | | | 2013 | | | | | | | | | | | | | | | | | | | — |

Barry J. West | | | 68 | | | | new | | | | X | | | | | | | | | | | | | | | — |

AC = Audit Committee; CC = Compensation Committee; NGC = Nominating and Corporate Governance Committee; C = Chairman; M = Member

| * | Effective immediately after the Annual Meeting. |

1 2011

Our Executive Compensation Program

Our executive compensation program is designed to attract, reward and retain a talented, innovative and entrepreneurial team of executives. To do so, we believe that a majority of their target compensation should be based on performance, both of the individual and of the business. We structure our variable compensation programs to recognize both short-term and long-term contributions.

Key Elements of Executive Compensation

| | |

Compensation Component | | Reason |

Base Salary | | We provide base salary as a fixed source of compensation for our executives for the services they provide to us during the year and to balance the impact of having a significant portion of their compensation “at risk” in the form of annual cash incentive bonuses and long-term equity-based incentive compensation. Our Compensation Committee recognizes the importance of a competitive base salary as an element of compensation that helps to attract and retain our executive officers. |

| |

Bonus | | Our 2013 bonus plan provided cash compensation opportunities to our named executive officers based on our achievement of pre-established performance goals derived from our Board-approved operating plan for 2013. In March 2013, the Compensation Committee approved a target cash incentive bonus award for each executive, and capped the maximum bonus award at twice the target level in the event that stretch performance goals were achieved. These levels were consistent with our philosophy that a significant portion of each executive’s total target cash compensation should be performance-based, and reflected the Compensation Committee’s review of internal pay equity and its conclusion that, except for Mr. Smith, no extraordinary factors created a need to modify the 2012 target bonus levels. Mr. Smith’s target bonus was increased effective as of January 1, 2013 from 60% to 70% to reflect his changing role and increased level of responsibility at our organization. |

| |

Equity-Based Incentive Compensation | | The Compensation Committee believes that properly structured equity compensation works to align the long-term interests of stockholders and employees by creating a strong, direct link between employee compensation and stock price appreciation. We have historically awarded equity in the form of options, which have an exercise price equal to the fair market value of a share of our common stock on the date of grant, and vest based on continued service over a specified period (typically, four years). As a result of the way we structure our option awards, options provide a return to the executive only if such officer remains employed by us, and then only if the market price of our common stock appreciates over the term of the option. In certain cases, we have also granted restricted stock units subject to time-based vesting. We also have a performance share program, which provides for the grant of performance-based restricted stock units. These performance shares provide a return to the executive if the executive remains employed by us and our company achieves specific performance targets from 2013 through 2014. |

2

Important Features of our Executive Compensation Program

The important features of our executive compensation program include:

YouOur executive compensation is heavily weighted toward at-risk, performance-based compensation in the form of an incentive cash bonus opportunity that is based on achievement of revenue, operational EBITDA, and sales and other strategic and financial goals selected annually by our Compensation Committee, and an equity compensation opportunity in the form of stock options, performance-based restricted stock units and time-based restricted stock units that provide incentives for our executives to meet certain performance goals and increase the market value of our common stock. In 2013, these forms of at-risk, performance-based compensation represented approximately 63% of our chief executive officer’s target total direct compensation, and an average of 54% of our other executives’ target total direct compensation.

Fifty percent of the value of annual equity awards vest based on the achievement of performance criteria.

The cash severance benefits that we offer to our executives do not exceed three times base salary and annual bonus.

We do not provide our executive officers with any excise tax or other tax gross ups.

We do not provide any defined benefit pension plans or supplemental employee retirement plans to our executive officers.

As further described below, our executives are cordially invitedrequired to attendcomply with our stock ownership guidelines, which we adopted in February 2012. Under these guidelines, our chief executive officer is required to accumulate shares of our common stock with a value equal to four times his annual base salary and our executive vice presidents, including our chief financial officer, chief operating officer and chief legal officer, are required to accumulate shares of our common stock with a value equal to two times their annual base salaries.

Our insider trading policy prohibits our employees, including our executives, directors and consultants, from hedging the economic interest in the Iridium shares they hold, and no pledges of stock occurred during 2013.

Our Compensation Committee has retained an independent third-party compensation consultant for guidance in making compensation decisions.

Our Compensation Committee reviews market practices and makes internal comparisons among our executives when making compensation decisions.

We structure our executive compensation program to try to minimize the risk of inappropriate risk-taking by our executives.

Advisory Vote on Executive Compensation—“Say-on-Pay Vote”

We conducted our third advisory vote on executive compensation, or say-on-pay vote, at our annual meeting of stockholders in person. Whether or not you expect2013. Approximately 90.9% of the votes cast on the say-on-pay proposal supported the proposal. Our Board and our Compensation Committee value the opinions of our stockholders, and we believe that it is important for our stockholders to attendhave an opportunity to vote on this proposal annually, which is consistent with the meeting, please complete, date, sign and return the enclosed proxy, or vote over the telephone or the Internet as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. Even if you have votedfrequency preferred by proxy, you may stillour stockholders. Our Compensation Committee’s decisions regarding compensation for 2013 reflected our say-on-pay vote in person if you attend2012, which was supported by approximately 91.5% of the meeting. Please note, however,votes cast

3

on the proposal. In addition to our annual advisory vote on executive compensation, we are committed to ongoing engagement with our stockholders on executive compensation and corporate governance issues.

While our 2013 say-on-pay vote was advisory only, our Compensation Committee has considered the results of the vote in the context of our overall compensation philosophy, policies and decisions. Our Compensation Committee believes that, if your shares are heldsimilar to our 2012 say-on-pay vote, this 2013 stockholder vote strongly endorsed our compensation philosophy and the decisions we made for 2012. After discussing the levels of record bysupport in each of the three years in favor of the proposals, and considering the Compensation Committee’s activity in 2012 to adopt additional measures, including stock ownership guidelines and a broker, bank or other nomineenew performance-based restricted stock unit program to further align management and you wishstockholder interests, our Compensation Committee decided to vote at the meeting, you must obtaingenerally maintain a proxy issued in your name from that record holder.consistent course for 2013 compensation decisions.

4

IRIDIUM COMMUNICATIONS INC.

1750 Tysons Boulevard, Suite 1400, McLean, Virginia 22102

PROXY STATEMENT

FOR THE 20112014 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 4, 201122, 2014

QUESTIONS QUESTIONSAND ANSWERS ABOUT THESE PROXY MATERIALS ANSWERS ABOUT THESE PROXY MATERIALSAND VOTING VOTING

Why amWHYAM I receiving these materials?RECEIVINGTHESEMATERIALS?

We have sent you these proxy materials because the Board of Directors of Iridium Communications Inc. (sometimes referred to as the Company or Iridium) is soliciting your proxy to vote at the 20112014 Annual Meeting of Stockholders, including at any adjournments or postponements of the meeting. You are invited to attend the annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy over the telephone or through the Internet.

We intend to mail these proxy materials on or about April 1, 201118, 2014 to all stockholders of record entitled to vote at the annual meeting.

How doHOWDO I attend the annual meeting?ATTENDTHEANNUALMEETING?

The meeting will be held on Wednesday,Thursday, May 4, 201122, 2014 at 9:008:30 a.m. localEastern time at the offices of Iridium Communications Inc., 1750The Ritz-Carlton, Tysons Corner, 1700 Tysons Boulevard, Suite 1400, McLean, Virginia 22102. Directions to our officesthe meeting location may be found at www.iridium.com.http://www.ritzcarlton.com/en/Properties/TysonsCorner/Information/Directions/Default.htm. Information on how to vote in person at the annual meeting is discussed below.

Who can vote at the annual meeting?WHOCANVOTEATTHEANNUALMEETING?

Only stockholders of record at the close of business on March 23, 2011April 1, 2014 will be entitled to vote at the annual meeting. On this record date, there were 70,253,60176,838,663 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If at the close of business on March 23, 2011April 1, 2014, your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone or onthrough the Internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If at the close of business on March 23, 2011April 1, 2014, your shares were held in an account at a brokerage firm, bank, dealer or other similar organization, rather than in your own name, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

1.5

What amWHATAM I voting on?VOTINGON?

There are fourthree matters scheduled for a vote:

the election of teneleven directors;

the advisory approval of the compensation of our named executive officers, as disclosed in this proxy statement in accordance with Securities and Exchange Commission, or SEC, rules;

the advisory indication of the preferred frequency of stockholder advisory votes on the compensation of our named executive officers; and

the ratification of the selection by the Board of Directors of Ernst & Young LLP or E&Y, as our independent registered public accounting firm for our fiscal year ending December 31, 2011.2014.

What if another matter is properly brought before the meeting?WHATIFANOTHERMATTERISPROPERLYBROUGHTBEFORETHEMEETING?

The Board of Directors knows of no other matters that will be presented for consideration at the annual meeting. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his best judgment.

How doHOWDO I vote?VOTE?

You may either vote “For” all the nominees to the Board of Directors or you may “Withhold” your vote for any nomineeone or more nominees you specify. With regard to the advisory vote on how frequently we should solicit stockholder advisory approval of executive compensation, you may vote for any one of the following: one year, two years or three years, or you may abstain from voting on that matter. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting.

The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the annual meeting, vote by proxy using the enclosed proxy card, vote by proxy over the telephone or vote by proxy through the Internet. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person even if you have already voted by proxy.

To vote in person, come to the annual meeting and we will give you a ballot when you arrive.

To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct.

To vote over the telephone, dial toll-free 1-800-PROXIES (1-800-776-9437) using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the enclosed proxy card. Your vote must be received by 11:59 p.m. localEastern time on May 3, 201121, 2014 to be counted.

To vote through the Internet, go to www.voteproxy.com to complete an electronic proxy card. You will be asked to provide the company number and control number from the enclosed proxy card. Your vote must be received by 11:59 p.m. localEastern time on May 3, 201121, 2014 to be counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may

2.

vote by telephone or overthrough the Internet as instructed by your broker or bank. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

6

|

We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies. |

We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

How many votes doHOWMANYVOTESDO I have?HAVE?

On each matter to be voted upon, you have one vote for each share of common stock you owned at the close of business on March 23, 2011.April 1, 2014.

What ifWHATHAPPENSIF I returnDONOTVOTE?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the Internet or otherwise vote butin person at the annual meeting, your shares will not be voted, nor will your shares count toward the establishment of a quorum for the meeting.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner and do not make specific choices?instruct your broker, bank or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the proposal is considered to be a “routine” matter. See below under “What are broker non-votes?” for more information. Accordingly, your broker or nominee may not vote your shares on Proposals 1 or 2 without your instructions, but may vote your shares on Proposal 3.

WHATIF IRETURNAPROXYCARDOROTHERWISEVOTEBUTDONOTMAKESPECIFICCHOICES?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of all teneleven nominees for director, “For” the advisory approval of executive compensation, “Abstain” in the vote for the preferred frequency of advisory votes to approve executive compensation and “For” the ratification of the selection by the Board of Directors of E&YErnst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2011.2014. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his best judgment.

Who is paying for this proxy solicitation?WHOISPAYINGFORTHISPROXYSOLICITATION?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees and Georgeson Inc., or Georgeson, may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies, but Georgeson will be paid its customary fee of approximately $6,500 plus out-of-pocket expenses if it solicits proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean ifWHATDOESITMEANIF I receive more than one set of proxy materials?RECEIVEMORETHANONESETOFPROXYMATERIALS?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the proxy cards in the proxy materials to ensure that all of your shares are voted.

7

CanCAN I change my vote after submitting my proxy?CHANGEMYVOTEAFTERSUBMITTINGMYPROXY?

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

You may submit another properly completed proxy card with a later date.

You may grant a subsequent proxy by telephone or through the Internet.

You may send a timely written notice that you are revoking your proxy to our Secretary at 1750 Tysons Boulevard, Suite 1400, McLean, Virginia 22102.

You may attend the annual meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy.

3.

Your most recent proxy card or telephone or Internet proxy is the one that is counted.

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.bank for changing your vote.

When are stockholder proposals due for next year’s annual meeting?WHENARESTOCKHOLDERPROPOSALSANDDIRECTORNOMINATIONSDUEFORNEXTYEAR’SANNUALMEETING?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 5, 2012,19, 2014 to our Secretary at 1750 Tysons Boulevard, Suite 1400, McLean, Virginia 22102. If you wish to submit a proposal that is not to be acted on at next year’s annual meeting but not included in next year’s proxy materials, or if you wish to nominate a director, you must provide written notice as required by our Bylaws no earlier than January 22, 2015 and no later than the close of business on February 6, 2012 and no earlier than January 5, 201221, 2015 to our Secretary at 1750 Tysons Boulevard, Suite 1400, McLean, Virginia 22102. You are also advised to review our Bylaws, filed with the SEC as an exhibit to a current report on Form 8-K on September 29, 2009, which contain additional requirements about advance notice of stockholder proposals and director nominations.

How are votes counted?HOWAREVOTESCOUNTED?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, for the proposal to elect directors, votes “For,” “Withhold” and broker non-votes; with respect to the proposal regarding frequency of stockholder advisory votes to approve executive compensation, votes for frequencies of one year, two years or three years, abstentions and broker non-votes; and, with respect to other proposals, votes “For” and “Against,” abstentions and, if applicable, broker non-votes. Abstentions will be counted towards the vote total for each proposal, other than the election of directors (Proposal 1) and the preferred frequency of stockholder advisory votes on the compensation of our named executive officers (Proposal 3), and will have the same effect as “Against” votes. For Proposal 3, abstentions will have no effect and will not be counted towards the vote total. Broker non-votes will have no effect and will not be counted towards the vote total for any proposal.

What are “broker non-votes”WHATARE “BROKERNON-VOTES”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the New York Stock Exchange, or NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of shareholders, such as mergers, shareholder proposals, elections of directors, even if not contested, and for the first time, under a new amendment to the NYSE rules, executive compensation, including the advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation. Broker non-votes are counted toward a quorum.

8

How many votes are needed to approve each proposal?HOWMANYVOTESARENEEDEDTOAPPROVEEACHPROPOSAL?

For Proposal No. 1, the election of directors, the teneleven nominees receiving the most “For” votes (from the holders of votes of shares present in person or represented by proxy and entitled to vote on the election of directors) will be elected. Only votes “For” or “Withheld”“Withhold” will affect the outcome.

To be approved, Proposal No. 2, the advisory approval of the compensation of our named executive officers, will be considered to be approved if it receives “For” votes from the holders of a majority of shares represented and entitled to vote thereat either in person or by proxy. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect.

4.

For Proposal No. 3, the advisory vote on the frequency of stockholder advisory votes on executive compensation, the frequency receiving the highest number of “For” votes from the holders of shares represented and entitled to vote thereat either in person or by proxy will be considered the frequency preferred by the stockholders. Abstentions and broker non-votes will have no effect.

To be approved, Proposal No. 4, the ratification of the selection by the Board of Directors of E&Y as our independent registered public accounting firm for our fiscal year ending December 31, 2011, must receive “For” votes from the holders of a majority of shares represented and entitled to vote thereat either in person or by proxy. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect.

What is

To be approved, Proposal 3, the quorum requirement?ratification of the selection by the Board of Directors of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2014, must receive “For” votes from the holders of a majority of shares represented and entitled to vote thereat either in person or by proxy. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect.

WHATISTHEQUORUMREQUIREMENT?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the meeting in person or represented by proxy. On the record date, there were 70,253,60176,838,663 shares outstanding and entitled to vote. Thus, the holders of 35,126,80138,419,332 shares must be present in person or represented by proxy at the meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the meeting in person or represented by proxy may adjourn the meeting to another date.

How canHOWCAN I find out the results of the voting at the annual meeting?FINDOUTTHERESULTSOFTHEVOTINGATTHEANNUALMEETING?

Preliminary voting results will be announced at the annual meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file with the SEC within four business days after the annual meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

What proxy materials are available on the Internet?WHATPROXYMATERIALSAREAVAILABLEONTHE INTERNET?

The proxy statement and annual report to stockholders are available at http://www.amstock.com/ProxyServices/ViewMaterials.asp?CoNumber=15777.www.astproxyportal.com/ast/15777/.

5.9

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors currently consists of teneleven directors. There are teneleven nominees for director this year. Each current director other than J. Darrel Barros is a nominee, and there is one new director nominee, Barry J. West. Mr. West was recommended for nomination to the Board of Directors by the Nominating and Corporate Governance Committee, after consideration by the Committee of a number of potential candidates identified by our chief executive officer. Each director to be elected and qualified will hold office until the next annual meeting of stockholders and until his successor is elected, or, if sooner, until the director’s death, resignation or removal. Each of the nominees listed below is currently a director of the Company. It is our policy to invite nominees for directors to attend the annual meeting. Last year, nineAll of our currently serving directors attended our annual meeting of stockholders.stockholders last year.

Directors are elected by a plurality of the votes of the holders of shares present in person or represented by proxy and entitled to vote on the election of directors. Proxies may not be voted for more than eleven nominees. The teneleven nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the teneleven nominees named below. If any nominee becomes unavailable for election as a result of an unexpected occurrence, your shares will be voted for the election of a substitute nominee proposed by us. Each person nominated for election has agreed to serve if elected. Our management has no reason to believe that any nominee will be unable to serve.

Our Corporate Governance Guidelines provide that any nominee who receives a greater number of votes “withheld” than votes “for” must submit an offer of resignation to our Nominating and Corporate Governance Committee. The committee will consider the facts and circumstances and recommend to the Board of Directors the action to be taken with respect to such offer of resignation. The Board of Directors will then act on the committee’s recommendation.

NOMINEES

The Nominating and Corporate Governance Committee of our Board seeks to assemble a board that, as a whole, possesses the appropriate balance of professional and industry knowledge, financial expertise and high-level management experience necessary to oversee and direct our business. To that end, the Nominating and Corporate Governance Committee has identified and evaluated nominees in the broader context of the Board’s overall composition, with the goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment and other qualities that the Nominating and Corporate Governance Committee views as critical to effective functioning of the Board.

The brief biographies below include information, as of the date of this proxy statement, regarding the specific and particular experience, qualifications, attributes or skills of each director or nominee that led the Board of DirectorsNominating and Corporate Governance Committee to believerecommend that thatperson as a nominee should continue to serve on the Board.for director. However, each member of the members of the Boardcommittee may have a variety of reasons why he believes a particular person would be an appropriate nominee for the Board, and these views may differ from the views of other members.

Robert H. Niehaus,Age 55. Mr. Niehaus age 58, has served as a memberdirector of our company since February 2008 and as Chairman of our Board of Directors since our inception and has served as our Chairman since September 2009. Mr. Niehaus also served as our Chief Executive Officer for a brief period in September 2009. He has beenMr. Niehaus is the founder and Chairman of GCP Capital Partners LLC, an investment firm formed in 2009 as the successor to Greenhill Capital Partners, since June 2000. Mr. Niehaus has been a memberthe merchant banking business of Greenhill’s management committee since its formation in January 2004.Greenhill & Co., Inc. Mr. Niehaus joined Greenhill & Co., Inc. in January 2000 as a Managing Director to begin the formation of Greenhill Capital Partners. He currently servesPartners and served as an Advisory Directorits Chairman and Chair of Greenhill & Co., Inc. and Chairman of GCP Capital Partners Holdings LLC. its Investment Committee from 2000 to 2009.

Prior to joining Greenhill, Mr. Niehaus spent 17 years at Morgan Stanley & Co., or Morgan Stanley, where he was a Managing Director in the merchant banking department from 1990 to 1999. Mr. Niehaus was Vice Chairman and a director of the private equity investment funds Morgan Stanley Leveraged Equity Fund II, L.P., a $2.2 billion private equity investment fund, from 1992 to 1999, and was Vice Chairman and a director of Morgan Stanley

10

Capital Partners III, L.P., a $1.8 billion private equity investment fund, from 1994 to 1999. Mr. Niehaus was also the Chief Operating Officer of Morgan Stanley’s merchant banking department from 1996 to 1998.

Mr. Niehaus currently serves as a director of Heartland Payment Systems, Inc., or Heartland,a publicly held provider of payment processing services, and previouslyseveral private portfolio companies of GCP Capital Partners. Within the past five years, he has also served as a directoron the boards of directors of the following publicly held companies: American Italian Pasta Company from 1992 to January 2008,companies Crusader Energy Group Inc. from July 2008 to July 2009,and EXCO Resources Inc. from November 2004 to June 2009, Global Signal, Inc. from October 2002 until its merger with Crown Castle International Corp., or Crown Castle, in January 2007, and Crown Castle from January 2007 to July 2007. Mr. Niehaus isreceived a graduateBachelor of Arts in International Affairs from the Woodrow Wilson School at Princeton University and a Masters of Business Administration degree from the Harvard Business School, from which he graduated with high

6.

distinction as a Baker Scholar. Our Board of Directors has concluded thatbelieves Mr. Niehaus shouldNiehaus’s qualifications to serve on theour Board and on the Compensation Committee based oninclude his extensive corporate management experience, his financial and investment banking expertise and his experience in working with telecommunications companies.

J. Darrel Barros, Age 50. Mr. Barros has servedserving on our Boardthe boards of Directors since September 2009. Mr. Barros has served as the Presidentdirectors of Syndicated Communications, Inc., a private equity fund focused on media and communications, since 2006. He also has served as President of VGC, PC, a Washington, D.C. based law firm specializing in private equity and early-stage investments, from 2003 to the present. Mr. Barros also served as a corporate and securities attorneynumerous companies, particularly in the venture capital practice group of DLA Piper US LLP from 1997 to 2003. He is currently Executive Chairman of Haven Media Group, LLC, a music-media company, and Chairman of Prestige Resort Properties, Inc., a resort and hospitality company. Mr. Barros is also a director of Maya Cinemas. Mr. Barros received a Bachelor of Science degree from Tufts University, a Master in Business Administration from the Amos Tuck School of Business in Dartmouth College, and a Juris Doctorate degree from the University of Michigan. Our Board of Directors has concluded that Mr. Barros should serve on the Board and on the Audit Committee based on his extensive experience in working with technology companies and his financial management experience.

Scott L. Bok, age 51. Mr. Bok has served on our Board of Directors since our inception. He also served as our Chairman and Chief Executive Officer from our formation in November 2007 until September 2009. Separately, Mr. Bok has served as Chief Executive Officer or Co-Chief Executive Officer of Greenhill & Co., Inc., since October 2007, served as its U.S. President between January 2004 and October 2007 and has been a member of its management committee since its formation in January 2004. In addition, Mr. Bok has been a director of Greenhill since its incorporation in March 2004. Mr. Bok joined Greenhill as a Managing Director in February 1997. Before joining Greenhill, Mr. Bok was a Managing Director in the mergers, acquisitions and restructuring department of Morgan Stanley where he worked from 1986 to 1997. From 1984 to 1986, Mr. Bok practiced mergers and acquisitions and securities law in New York with Wachtell, Lipton, Rosen & Katz. Mr. Bok was previously a member of the Board of Heartland from 2001 to 2008. Mr. Bok is a graduate of the University of Pennsylvania’s Wharton School. He holds a Juris Doctorate from the University of Pennsylvania Law School. Our Board of Directors has concluded that Mr. Bok should serve on the Board and on the Nominating and Corporate Governance Committee based on his extensive corporate management experience and his financial expertise.telecommunications industry.

Thomas C. Canfield,,Age 55. Mr. Canfield age 58, has served onas a director of our Board of Directorscompany since our inception.February 2008. Since October 2007, Mr. Canfield has served as Senior Vice President-GeneralPresident, General Counsel &and Secretary of Spirit Airlines, Inc. sinceFrom September 2006 to October 2007. Previously,2007, Mr. Canfield wasserved as General Counsel & Secretary of Point Blank Solutions, Inc. and was, a manufacturer of antiballistic body armor. Prior to Point Blank, from 2004 to 2007, he served as Chief Executive Officer and Plan Administrator for AT&T Latin America Corp. Prior to assuming those roles, Mr. Canfield was General Counsel and Secretary of AT&T Latin America Corp. following its acquisition by, a public company formerly known as FirstCom Corporation.Corporation, which developed high-speed fiber networks in Latin American cities. Mr. Canfield also served as General Counsel and Secretary at AT&T Latin America Corp. filed for bankruptcy in April 2003. Mr. Canfield became General Counsel of FirstCom in May 2000. Priorfrom 1999 to joining FirstCom,2004. Previously, Mr. Canfield was Counsel in the New York office of the law firm Debevoise & Plimpton LLP, where for nineLLP. Within the past five years, he practiced in the areas of corporate, securities and international transactions. Mr. Canfield previously served as a member of the Boardboard of Directorsdirectors of Tricom SA from 2004 until 2010 and asS.A., a member of the Board of Directors of Birch Telecom Inc. from 2006 to 2008.publicly held telecommunications company. Our Board of Directors has concluded thatdirectors believes Mr. Canfield shouldCanfield’s qualifications to serve on theour Board and on the Audit Committee based oninclude his management experience in the telecommunications industry and his particular familiarity with serving on the boardsas a director of technology companies.

Brigadier Gen. Peter M. Dawkins (Ret.),,age 73. Brigadier General Dawkins, U.S. Army (Retired),76, has served onas a director of our Board of Directorscompany since October 2009. Gen. Dawkins has been a Senior Partner at Flintlock Capital Asset Management LLC since July 2009. Gen. DawkinsHe is currently a member of the advisory board of Wilmington Trust FSB. He is also Founder and Principal of ShiningStar Capital LLC, or ShiningStar, which he founded in May 2008. Prior2008, and a Senior Advisor to founding ShiningStar, Gen.Virtu Financial LLC. Previously, General Dawkins wasserved as Vice Chairman of Global Wealth Management for Citigroup Inc., or Citigroup, from August 2007 to May 2008,as Vice Chairman of the Citigroup Private Bank, from

7.

2000 to August 2007, and as Executive Vice President and Vice Chairman of The Travelers Companies, Inc. during an eleven-yeareleven year tenure with thethat firm. Previously, fromFrom 1991 to 1996, he served as Chairman and Chief Executive Officer of Primerica Financial Services, Inc., and earlier served as head of the U.S. consulting practice of Bain & Company Inc. Gen.General Dawkins began his career in the private sector as head of the Public Financing Banking division of Lehman Brothers Holdings Inc. A 1959 graduate of the United States Military Academy at West Point, Gen.General Dawkins served in the U.S. Army for 24 years. He wasyears, being promoted to Brigadier General in 1981. Gen. Dawkins holds a Ph.D. and Master’s degree from the Woodrow Wilson School at Princeton University. He was selected as a Rhodes Scholar and studied at Oxford University, later earning Ph.D. and Master of Public Administration degrees from 1959 through 1962.the Woodrow Wilson School at Princeton University. General Dawkins is currently a member of the advisory board of Wilmington Trust FSB. Our Board of Directors has concluded that Gen. Dawkins shouldbelieves General Dawkins’s qualifications to serve on theour Board based oninclude his extensive corporate management experience, his military experience and his financial expertise.

Matthew J. Desch,, age 53. Mr. Desch56, has beenserved as our Chief Executive Officer and a memberdirector of our Board of Directorscompany since September 2009 when we purchased, directly or indirectly, all of the outstanding equity of Iridium Holdings LLC, or Iridium Holdings, in a transaction that we refer to as the Acquisition. Mr. Deschand previously served as Chief Executive Officer of Iridium Holdings from August 2006 to September 2009. Before that, he wasFrom 2002 to 2005, Mr. Desch served as Chief Executive Officer of Telcordia Technologies, Inc., or Telcordia, a telecomtelecommunications software services provider, from 2002 to November 2005. Prior to Telcordia,provider. Previously, he spent 13 years at Nortel Networks Corporation, or Nortel, including as President forof its global wireless networks business from 1996 to 1999 and as President of Global Carriers responsible for all carrier customers outside of North America, from 1999 until he left in Marchto 2000. Within the past five years, Mr. Desch served on the Boardboards of Directorsdirectors of the public companies Starent Networks Corp. from 2005 until late 2009 and served on the Board of Directors of Airspan Networks, Inc. from 2000 to 2009. He hasalso serves on the President’s National Security Telecommunications Advice Committee. He received a Bachelor of Science degree in Computer Science from The Ohio State University and a Master of Business Administration from the University of Chicago. Our Board of Directors has concluded thatbelieves Mr. Desch shouldDesch’s qualifications to serve on theour Board based oninclude his deep knowledge of our company gained from his position as our Chief Executive Officer and previously as the Chief Executive Officer of Iridium Holdings, as well as his extensive experience in the telecommunications industry.

11

Terry L. JonesThomas J. Fitzpatrick, age 56, has served as our Chief Financial Officer since April 2010 and as our Chief Administrative Officer and a director of our company since August 2013. From 2002 to December 2009, Mr. Fitzpatrick was Executive Vice President and Chief Financial Officer of Centennial Communications Corp., age 64a publicly traded telecommunications company that was acquired by AT&T in November 2009. Previously, Mr. Fitzpatrick served as Chief Financial Officer of a number of privately held and publicly traded companies in the telecommunications and technology industries and was a Vice President with Bell Atlantic Corporation (now Verizon). Mr. Jones has served on our Board of Directors since the Acquisition in September 2009 and served on the Board of Directors of Iridium Holdings from 2001 to September 2009. Mr. Jones is the Managing Member of the General Partner of Syndicated Communications Venture Partners IV, L.P. and the Managing Member of Syncom Venture Management Co., LLC. Prior to joining Syncom in 1978, he was co-founding stockholder and Vice President of Kiambere Savings and Loan in Nairobi, and a lecturer at the University of Nairobi. He also worked as a Senior Electrical Engineer for the Westinghouse Electric Corporation, Aerospace Division, and Litton Industries Corp. He is a member of the Boards of Directors of Radio One, Inc. and PKS Communications, Inc. He formerly served on the Board of the Southern African Enterprise Development Fund, and is on the Board of Trustees of Spellman College. Mr. Jones receivedFitzpatrick graduated with a Bachelor of ScienceBusiness Administration degree in Electrical Engineering from Trinity College,Pennsylvania State University and a Master of Science degree in Electrical Engineering from George Washington University and a Masters of Business Administration degree from HarvardVillanova University. Mr. Fitzpatrick is also a Certified Public Accountant. Our Board of Directors has concluded thatbelieves Mr. Jones shouldFitzpatrick’s qualifications to serve on theour Board and on the Compensation and Nominating and Corporate Governance Committees based on his extensive corporate management experience and, as a long-term member of the Board of Iridium Holdings,include his deep knowledge of our company.company gained from his position as our Chief Financial Officer, as well as his extensive financial experience in the telecommunications industry.

Alvin B. Krongard,, age 74. Mr. Krongard77, has served as a memberdirector of our Board of Directorscompany since the Acquisition in September 2009 and previously served as a member of the Board of Directorsdirector of Iridium Holdings from 2006 tountil September 2009. Since 2004, Mr. Krongard has been pursuingpursing personal interests. In 1991,He served as Executive Director of the Central Intelligence Agency from 2001 to 2004 and as counselor to the Director of the Central Intelligence Agency from 2000 to 2001. Mr. Krongard was electedpreviously served in various capacities at Alex.Brown, Incorporated, including serving as Chief Executive Officer of Alex. Brown Incorporated, or Alex. Brown, an investment banking firm,beginning in 1991 and in 1994, he becameassuming additional duties as Chairman of the Boardboard of Directorsdirectors in 1994. Upon the merger of Alex. Brown.Alex.Brown with Bankers Trust Corporation in 1997, Mr. Krongard also served asbecame Vice Chairman of the Board of Directors of Bankers Trust Company N.A. from 1997 to 1998,and served in addition to holding other financial industry posts. He served as Counselor tosuch capacity until joining the Director of the U.S. Central Intelligence Agency from 1998 to 2001,in 1998. He currently serves as the lead independent director and then as Executive Directorchairman of the CIA from 2001 to 2004. Mr. Krongard served onaudit committee of the Boardboard of Directors of PHH Corporation from January 2005 to June 2009. He serves on the Board of Directorsdirectors of Under Armour, Inc., and also serves as Vice Chairmana director of The Johns Hopkins Health System Corporation.Apollo Global Management and a member of the audit committee of its board of directors. Mr. Krongard

8.

received a Bachelor of Arts degree graduated with honors from Princeton University and received a Juris Doctorate degreeJ.D. from the University of Maryland School of Law.Law, where he also graduated with honors. Mr. Krongard also serves as the Vice Chairman of the Johns Hopkins Health System. Our Board of Directors has concluded thatbelieves Mr. Krongard shouldKrongard’s qualifications to serve on theour Board include his past leadership experience with a large publicly-traded investment banking firm Alex.Brown, Incorporated, including as Chief Executive Officer and on the Compensation and Nominating and Corporate Governance Committees based on his extensive corporate management experience, his experience leading an agency of the U.S. government and, as a memberChairman of the Board, his past leadership experience with the Central Intelligence Agency, including serving as Executive Director responsible for overall operations of Iridium Holdings,the agency, and his deep knowledge of our company.company dating to his time as a director of Iridium Holdings.

Admiral Eric T. Olson (Ret.), age 62, has served as a director of our company since December 2011. Admiral Olson retired from the United States Navy in 2011 as a full Admiral after 38 years of military service. He served in special operations units throughout his career, during which he earned a Master’s Degree in National Security Affairs and was awarded several decorations for leadership and valor, including the Defense Distinguished Service Medal and the Silver Star. Admiral Olson was the first Navy SEAL officer to be promoted to three- and four-star ranks. Admiral Olson’s career culminated as the head of the United States Special Operations Command from July 2007 to August 2011, where he was responsible for the mission readiness of all Army, Navy, Air Force, and Marine Corps special operations forces. As President and Managing Member of ETO Group, LLC since September 2011, Admiral Olson is now an independent national security consultant who supports a wide range of private and public sector organizations. Admiral Olson serves on the board of directors of Under Armour, Inc. and is a member of its nominating and corporate governance committee and also serves as a Director of the non-profit Special Operations Warrior Foundation. Admiral Olson graduated from the United States Naval Academy in 1973 and earned a Master of Arts degree in National Security Affairs at the Naval Postgraduate School. He is an Adjunct Professor in the School of International and Public Affairs at Columbia University. Our Board of Directors believes Admiral Olson’s qualifications to serve on our Board include his past leadership experience as Admiral in the United States Navy, including his leadership and management of a large and complex organization as head of the United States Special Operations Command.

Steven B. Pfeiffer,Age 64. Mr. Pfeiffer age 67, has served onas a director of our Board of Directorscompany since September 2009 and served on the Board of Directors of Iridium Holdings from 2001 to September 2009. Mr. Pfeiffer has been a partner in the law firm of Fulbright & Jaworski LLP since 1983 and has served as the elected ChairChairman of the firm’sits Executive Committee since 2003.from 2003 to 2012. He previously served as the Partner-In-Charge of the Washington, D.C. and London offices, and headed

12

the firm’s International Department. In 2013, Fulbright & Jaworski LLP became a member of Norton Rose Fulbright Verein, a Swiss Verein. Mr. Pfeiffer is also a Non-Executive Director of Barloworld Limited, (aa public company in South Africa on whose compensation, nominating and general purposes committeecommittees he serves) in South Africa,also serves. Mr. Pfieffer is a Non-Executive Director of Borghese International Ltd. He also serves as Chairman Emeritus of Wesleyan University, a Trustee of The Africa-America Institute in New York, a Director of Project HOPE in Washington, D.C., and a Director of the NAACP Legal Defense and Educational Fund, Inc. Mr. Pfeiffer received a Bachelor of Arts degree from Wesleyan University and studied at Oxford University as a Rhodes Scholar, completing a Bachelor of Arts degree and a Masters degree in jurisprudence. He also holds a Masters degree in Area Studies (Africa) from the School of Oriental and African Studies of the University of London and holds a Juris Doctorate degree from Yale University. Mr. Pfeiffer served as an officer on active and reserve duty in the U.S. Navy. In 2010, he was recognized by the National Association of Corporate Directors (NACD) as one of the top 100 non-executive directors in the United States. Our Board of Directors has concluded thatbelieves Mr. Pfeiffer shouldPfeiffer’s qualifications to serve on theour Board and on the Compensation Committee based oninclude his extensive corporate management experience, his experience in working with technology companies, and, as a long-term member of the Board of Directors of Iridium Holdings, his deep knowledge of our company.

Parker W. Rush,, age 51.54, has served as a director of our company since February 2008. Since July 2012, Mr. Rush has served on our Boardas Chief Executive Officer of Directors since our inception.ClearView Risk Holdings LLC. Since March 2012, he has also served as a Partner at Consult PWR, LLC. From 2003 until March 2012, Mr. Rush has served as the President and Chief Executive Officer and as a member of the Boardboard of Directorsdirectors of Republic Companies Group, Inc., or Republic, a provider of property and casualty insurance since December 2003. Prior to his employment with Republic,company. Previously, Mr. Rush served in various capacities at The Chubb Corporation from 1980 to 2003, including as a Senior Vice President and Managing Director at The Chubb Corporation and in various other capacities since February 1980.Director. Mr. Rush alsoreceived a Bachelor of Business Administration degree from the University of Texas. Mr. Rush currently serves as a member of the Boardsboards of Directors fordirectors of American Independent Insurance Company and ArtBanc International, Ltd., Inc. Mr. Rush is also anand as a member of the Advisory Board Member for the Dallas/Ft.Dallas / Fort Worth Salvation Army. Our Board of Directors has concludedbelieves that Mr. Rush shouldRush’s qualifications to serve on theour Board and on the Audit Committee based oninclude his extensive corporate management experience and his financial expertise,expertise.

S. Scott Smith, age 55, has served as our Chief Operating Officer and a director of our company since August 2013. He previously served as our Executive Vice President, Satellite Development and Operations from April 2010 to August 2013. From 2006 to March 2010, Mr. Smith served as Chief Operating Officer of DigitalGlobe Inc. From 1995 to 2006, he held various positions at Space Imaging Inc., most recently as Executive Vice President, Sales, Engineering and Operations. Previously, Mr. Smith served in a number of engineering and management positions with Lockheed Missiles & Space Company. Mr. Smith is currently a member of the board of directors of SkyBox Imaging, Inc. He received a Bachelor of Science degree in Aerospace Engineering from Syracuse University and a Master of Science degree in Aeronautical and Astronautical Engineering from Stanford University. Our Board of Directors believes Mr. Smith’s qualifications to serve on our Board include his deep knowledge of our company gained from his previous position as our Executive Vice President, Satellite Development and Operations.

Barry J. West, age 68, is a director nominee and has not previously served on our Board of Directors. Mr. West has served as Chief Executive Officer of Collision Communications Inc., a telecommunications company, since May 2011. From June 2010 to May 2011, he was a consultant to companies in the mobile broadband industry. From November 2008 to June 2010, he served as the President and Chief Architect of Clearwire Corporation and as its President of International Operations. From 2005 to November 2008, he served in a number of roles with Sprint Nextel Corp., including as its Chief Technical Officer and President of its 4G Mobile Broadband unit (XOHM). From 1996 to 2005, he served as Chief Technology Officer and Executive Vice President of Nextel Communications, Inc. Prior to joining Nextel, Mr. West served in a number of senior positions with British Telecom for more than 35 years, most recently as director of value-added services and corporate marketing at Cellnet, a cellular communications subsidiary of British Telecom. Our board of directors believes that Mr. West’s qualifications to serve on the board include his qualification as an audit committee financial expert under SEC guidelines.extensive technology background and corporate management experience in the telecommunications industry.

13

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE “FOR” EACH NAMED NOMINEE.

INFORMATION REGARDING THE BOARD OF DIRECTORS AND COMMITTEES

AND CORPORATE GOVERNANCE

DIRECTORINDEPENDENCEOF THE BOARDOF DIRECTORS

As required under the NASDAQ listing standards, a majority of the members of a listed company’s Boardboard of Directorsdirectors must qualify as “independent,” as affirmatively determined by the Boardits board of Directors.directors. Consistent with these considerations, after review of all relevant identified transactions or relationships between each of our directors and the new director nominee, or any of histheir respective family members, and us, our senior management and our independent registered public accounting firm, the Board has affirmatively determined that the following nineeight currently serving directors are independent directors within the meaning of the applicable NASDAQ listing standards: Messrs. Barros, Bok, Canfield, Dawkins, Jones, Krongard, Niehaus, Olson, Pfeiffer and Rush. The Board also has determined that Mr. West, the new director nominee, is independent under the applicable NASDAQ listing standards. In making this determination, the Board found that none of these directors or the new director nominee had a material or other disqualifying relationship with us. Mr.Messrs. Desch, isFitzpatrick and Smith are not an independent directordirectors by virtue of his positiontheir positions as executive officers of our Chief Executive Officer.company.

9.

BOARD LEADERSHIP STRUCTURE

Our Board of Directors has an independent Chairman, Mr. Niehaus, who has authority, among other things, to call and preside over Board meetings, including meetings of the independent directors, to set meeting agendas and to determine materials to be distributed to the Board. Accordingly, the Chairman has substantial ability to shape the work of the Board. We believe that separation of the positions of Chairman and Chief Executive Officerchief executive officer reinforces the independence of the Board in its oversight of our business and affairs. In addition, we believe that having an independent Chairman creates an environment that is more conducive to objective evaluation and oversight of management’s performance, increasing management accountability and improving the ability of the Board to monitor whether management’s actions are in the best interests of us and our stockholders. As a result, we believe that having an independent Chairman can enhance the effectiveness of the Board as a whole.

ROLEOF THETHE BOARDIN RISK OVERSIGHT

One of the Board’s key functions is informed oversight of our risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, while our Board is responsible for monitoring and assessing strategic risk exposure, our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. Our Audit Committee also monitors compliance with legal and regulatory requirements. Our Nominating and Corporate Governance Committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. It is the responsibility of the committee chairs to report findings regarding material risk exposures to the Board. The Chairman has the responsibility of coordinating between the Board and management with regard to the determination and implementation of responses to any problematic risk management issues.

MEETINGSOF THETHE BOARDOF DIRECTORS

The Board of Directors met five times during 2010.2013. Each Board member attended 75% or more of the aggregate number of meetings of the Board and of the committees on which he served that were held during the year.portion of the year for which he was a director or committee member.

14

INFORMATION REGARDING COMMITTEESOFTHE BOARDOF DIRECTORS

Our Board has three committees:committees that include an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The following table provides membership and meeting information for 20102013 for each of thethese Board committees:

| Name | | Audit | | Compensation | | Nominating and Corporate

Governance | | | Audit | | Compensation | | Nominating and Corporate

Governance |

Robert H. Niehaus | | | | | X | | | | | | | X | | |

J. Darrel Barros | | | X | | | | | | |

Scott L. Bok | | | | | | | X | * | |

Thomas C. Canfield | | | X | | | | | | |

Terry L. Jones | | | | | X | | | | X | | |

J. Darrel Barros** | | | X | | | | |

Scott L. Bok*** | | | | | | | X |

Thomas C. Canfield**** | | | X | | | | X |

Alvin B. Krongard | | | | | X | | | | X | | | | | X | | X* |

Admiral Eric T. Olson (Ret.) | | | | | | | X |

Steven B. Pfeiffer | | | | | X | * | | | | | | X* | | |

Parker W. Rush | | | X | * | | | | | | X* | | | | |

Total meetings in 2010 | | | 7 | | | | 5 | | | | 1 | | |

Total meetings in 2013 | | | 6 | | 5 | | 2 |

10.

| ** | Effective at the annual meeting Mr. Barros will no longer serve on our Board. The Board has approved the appointment of General Dawkins to the Audit Committee to fill the vacancy that will be created by the departure of Mr. Barros, effective as of the conclusion of the annual meeting. |

| *** | Mr. Bok’s term as a director expired on May 9, 2013. |

| **** | Mr. Canfield was appointed to the Nominating and Corporate Governance Committee on May 9, 2013. |

Below is a description of each committee of our Board of Directors. The Board of Directors has determined that each member of each committee is independent within the meaning of the NASDAQ listing standards and that each member is free of any relationship that would impair his individual exercise of independent judgment with regard to us.

Audit Committee

The Audit Committee of our Board of Directors was established by the Board to oversee our corporate accounting and financial reporting processes and audits of itsour financial statements. For this purpose, the Audit Committee performs several functions. The Audit Committee evaluates the performance of, and assesses the qualifications of, the independent registered public accounting firm; determines and approves the engagement of the independent registered public accounting firm; determines whether to retain or terminate the existing independent registered public accounting firm or to appoint and engage a new independent registered public accounting firm; reviews and approves the retention of the independent registered public accounting firm to perform any proposed permissible non-audit services; monitors the rotation of partners of the independent registered public accounting firm on our audit engagement team as required by law; reviews and approves or rejects transactions between us and any related persons; confers with management and the independent registered public accounting firm regarding the effectiveness of internal controls over financial reporting; establishes procedures, as required under applicable law, for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; and meets to review our annual audited financial statements and quarterly financial statements with management and the independent registered public accounting firm. firm, including a review of our disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The Audit Committee is currently composed of Messrs. Rush (Chairman), Barros and Canfield. As described above, following the annual meeting, General Dawkins will replace Mr. Barros on the Audit Committee. In 2010,2013, the Audit Committee met sevensix times. The Audit Committee has adopted a written charter that is available to stockholders on our website at http://investor.iridium.com/governance.cfm.

15

At least annually, the Board of Directors reviews the NASDAQ listing standards definition of independence for Audit Committee members and has determined that all members of our Audit Committee are independent. The Board of Directors has also determined that Mr. Rush qualifies as an “audit committee financial expert,” as defined in applicable SEC rules.

Report of the Audit Committee of the Board of Directors

The Audit Committee has reviewed and discussed the audited financial statements for the year ended December 31, 20102013 with management of Iridium Communications Inc. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA,16,Professional StandardsCommunications with Audit Committees, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board, or PCAOB, in Rule 3200T.PCAOB. The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the audit committee concerning independence, and has discussed with the independent registered public accounting firm the accounting firm’s independence. Based on the foregoing, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2010.2013.

Respectfully submitted,

AUDIT COMMITTEE

Parker W. Rush, Chairman

J. Darrel Barros

Thomas C. Canfield

11.

The material in this report of the audit committee is not “soliciting material,” is furnished to, but not deemed “filed” with, the SEC and is not deemed to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Securities Act, or the Securities Exchange Act of 1934, as amended, or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

16

Compensation Committee

Our Compensation Committee is composed of Messrs. Pfeiffer (Chairman), Jones, Krongard and Niehaus. All members of our Compensation Committee are independent within the meaning of the NASDAQ listing standards. In 2010,2013, the Compensation Committee met five times. The Compensation Committee has adopted a written charter that is available to stockholders on our website at http://investor.iridium.com/governance.cfm.

The Compensation Committee acts on behalf of the Board to oversee our compensation policies, plans and programs, including with respect to salary, long-term incentives, bonuses, perquisites, equity incentives, severance arrangements, retirement benefits and other employee benefits, and to review and determine the compensation to be paid to our executive officers and directors. The Compensation Committee has also made a non-exclusive delegation of certain authorities to a subcommittee tasked with approving both cash and equity compensation that may qualify as “performance-based compensation” under Section 162(m) of the Internal Revenue Code, or the Code, which we refer to as the performance subcommittee.

Our Compensation Committee also reviews with management our Compensation Discussion and Analysis and considers whether to approve its inclusion in proxy statements and other filings.

Typically, the Compensation Committee meets quarterly and with greater frequency if necessary. The agenda for each meeting is usually developed by the Chairman of the Compensation Committee. The Compensation Committee meets regularly in executive session. However, from time to time, various members of management and other employees as well as outside advisors or consultants may be invited by the Compensation Committee to make presentations, to provide financial or other background information or advice or to otherwise participate in Compensation Committee meetings. The Chief Executive Officer may not participate in, or be present during, any deliberations or determinations of the Compensation Committee regarding his compensation or individual performance objectives. The charter of the Compensation Committee grants the Compensation Committee full access to all of our books, records, facilities and personnel, as well as authority to obtain, at our expense, advice and assistance from internal and external legal, accounting or other advisors and consultants and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. In particular, the Compensation Committee has the sole authority to retain compensation consultants to assist in its evaluation of executive and director compensation, including the authority to approve the consultant’s reasonable fees and other retention terms. Under its charter, the Compensation Committee may select, or receive advice from, a compensation consultant, legal counsel or other adviser to the compensation committee, other than in-house legal counsel and certain other types of advisers, only after taking into consideration six factors, prescribed by the SEC and NASDAQ, that bear upon the adviser’s independence; however, there is no requirement that any adviser be independent.

During 2010,2013, after taking into consideration the six factors prescribed by the SEC and NASDAQ described above, our Compensation Committee engaged a compensation consultant, Frederic W. Cook & Co., Inc., to perform the services described in “Executive Compensation—Compensation Discussion and Analysis—Use of Compensation Consultant.”